In today’s high-speed world, unforeseen monetary hurdles often take us by surprise. Be it an abrupt health-related cost, a home revamp necessity, or the requirement of a two-wheeler for city commuting, the need for urgent online loans has never been more prominent. This piece shines light on quick relief avenues as we delve deeper into various strategies that deliver prompt solutions to our financial needs.

The Need for Speed

The unpredictability of life can catch us off guard when we are least prepared. Emergencies exhibit no regard for timing, requiring swift intervention and, crucially, instantaneous monetary support. Here’s where the idea of prompt assistance comes into play – serving as a safety buffer for people tackling unexpected financial challenges.

Lightning-Fast Personal Loans

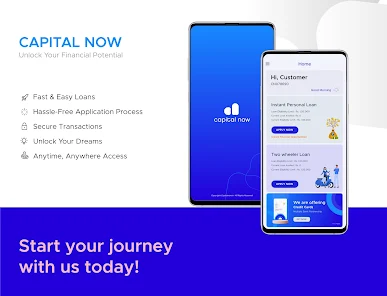

The instant personal loans have surfaced as a shining light for those desperately requiring monetary help. Their easy-to-navigate application routine and swift authorizations extend urgent aid to individuals grappling with unforeseen costs. The capacity of personal loans to deliver instant support, whether it’s tackling medical bills or home renovations, barely needs further emphasis.

Navigating the Two-Wheeler Loan Express

In the lives of countless people, a bicycle or motorcycle is not merely a means to get around—it’s their gateway to possibilities and ease. When an unforeseen need for another vehicle pops up, speedy bike financing can be transformative. Going this personal loan apps guarantees quick approval and enables folks to continue fulfilling day-to-day responsibilities without undue interruptions.

The Simplicity of Application

The quick pace of these fiscal resolutions traces back to the uncomplicated application process they offer. Extensive paperwork of cash loan and prolonged waiting times are now a thing of the past. Nowadays, individuals who wish to borrow can fill out their applications virtually from home or even on the move, drastically cutting down on time before they get hold of the necessary funds.

Empowering Lives Through Quick Solutions

Quickly providing aid doesn’t just offer immediate monetary assistance. The knock-on effects positively ripple through to the day-to-day experiences of individuals and families. This swift action of instant personal loan online app kindles a can-do spirit, helping people meet their trials with resilience – bolstering financial health in turn. Acting swiftly during crises not only softens current hardships but also paves the way for lasting fiscal solidity down the line.

Building Trust Through Transparency

For speedy solutions, trust plays a vital role all on its own. Open and clear dialogue about the rules of engagement and terms of agreement, along with when and how to repay loans, builds solid ground between banks or lenders and those who borrow from them. This open-book approach does more than just pave the way for hassle-free transactions; it also acts as a key building block in forming positive bonds related to money matters!

Wrapping Up:

By adopting the attitude of swift assistance, we uncover not just a remedy for pressing economic necessities but likewise an avenue towards self-reliance and endurance. This serves as a reaffirmation that amidst unpredictability, there exist resources capable of transforming barriers into prospects. Swift aid is not merely about finances; it’s about acknowledging our capacity for constructive adaptation and advancement in life. While traversing through this evolving terrain called financial services, let’s celebrate how instant help can inspire lives—through one loan at a time.